Here you may maintain adhoc payroll item and determine which month to process it.

Go to Payroll > Payroll Management > Adhoc Payroll Item

Example:

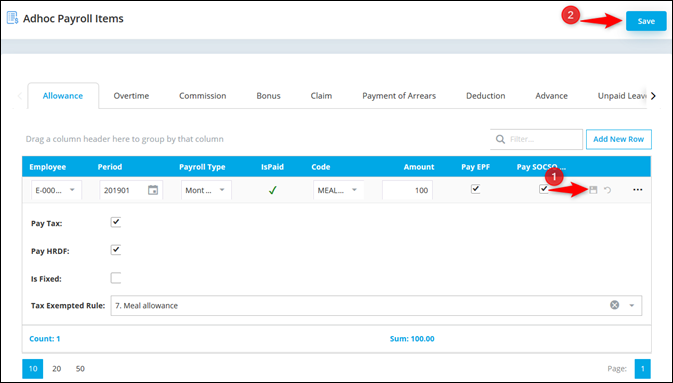

(i) Employee E-0001 got meal allowance for January 2019 payroll

Go to Allowance tab and click on Add New Row button. Key in all information, click on Save icon then Save button.

Employee: Select employee

Period: Select which period to process adhoc item

Payroll Type: Select Payroll Type

First Half

Month End/Second Half

Is Paid: This column will be ticked once you already process payroll

Code: Select maintained allowance code

Amount: Key in allowance amount

![]() *Statutory Setting:

*Statutory Setting:

Tax Exempted Rule: Select tax exempted rule to set this allowance to be exempted from tax calculation.

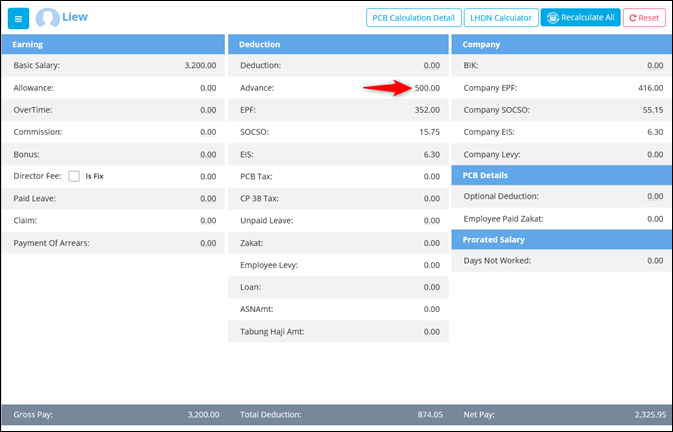

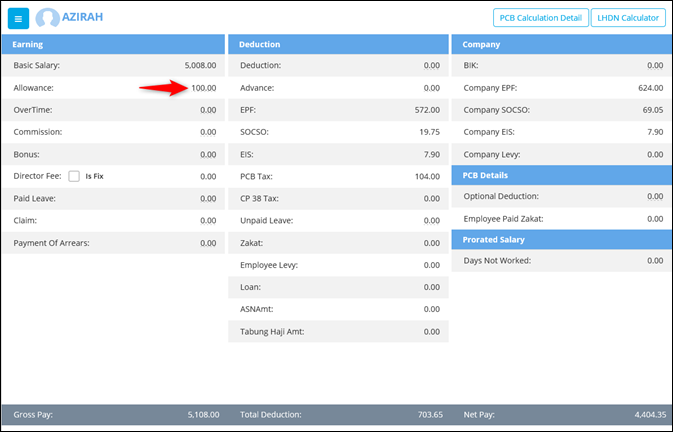

After process January Payroll, allowance amount will be updated in the payroll.

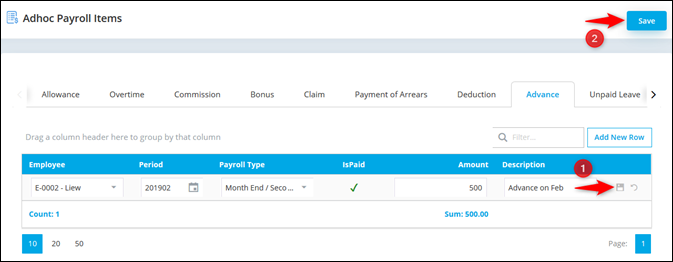

(ii) Employee E-0002 is taking advance salary RM500 and wish to deduct in February 2019 payroll

Go to Advance tab and click on Add New Row button. Key in all information, click on Save icon then Save button.

Employee: Select employee

Period: Select which period to process adhoc item

Payroll Type: Select Payroll Type

First Half

Month End/Second Half

Is Paid: This column will be ticked once you already process payroll

Amount: Maintain advance amount

Description: Maintain advance description

After process payroll, advance amount will reflect in the deduction part.