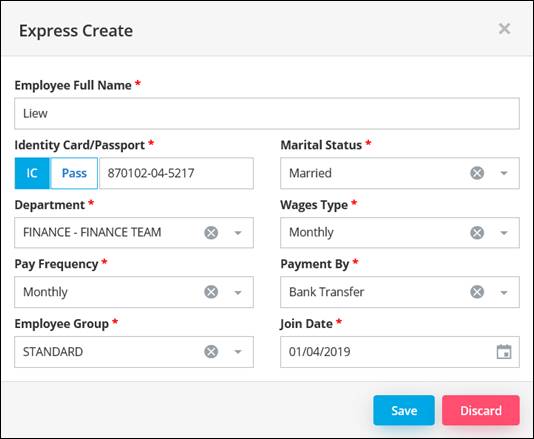

Express: Click on Express button to express create employee with required field only.

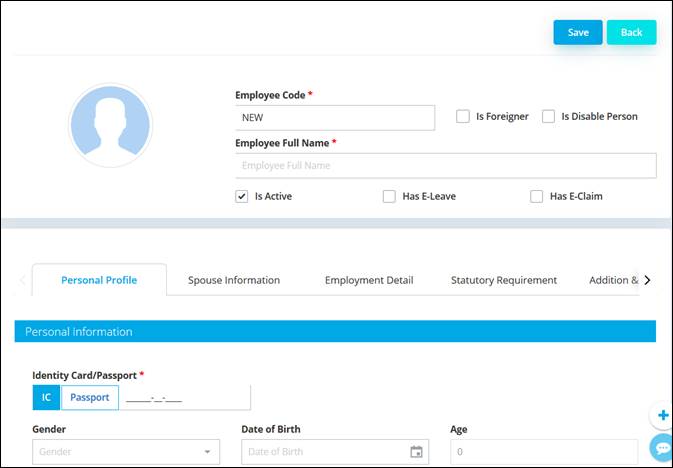

Add New: Click on Add New button to create a new Employee.

Employee Maintenance got 6 sections that you need to fill in. Field with label (*) is a required field.

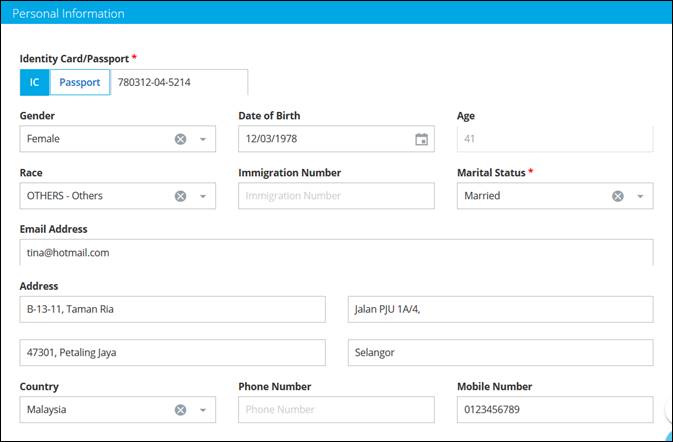

Personal Profile

Go to Personal Profile tab to maintain employee’s personal information.

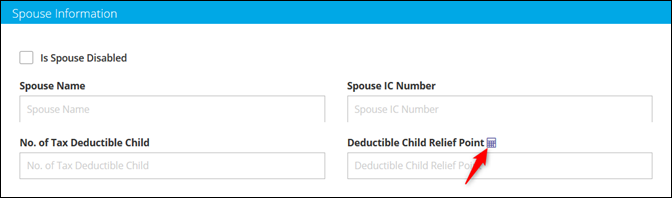

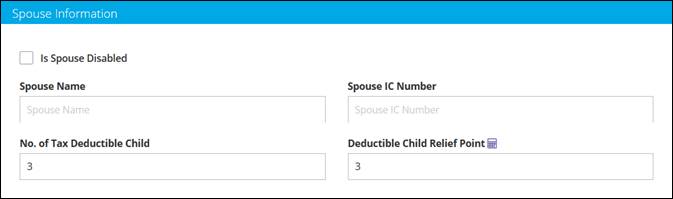

i) Spouse Information

Go to Spouse Information tab to maintain employee’s spouse information and number of children.

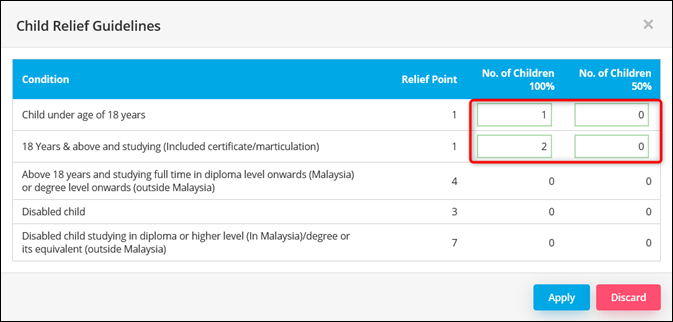

To maintain child information, click on the calculator icon.

Child Relief Guideline screen will be prompted. You may key in the information and click on Apply.

It will be updated in the system.

No Of Tax Deductible Child: Actual number of children qualified for Tax Relief.

Deductible Child relief Point: Number of point for child Tax Relief.

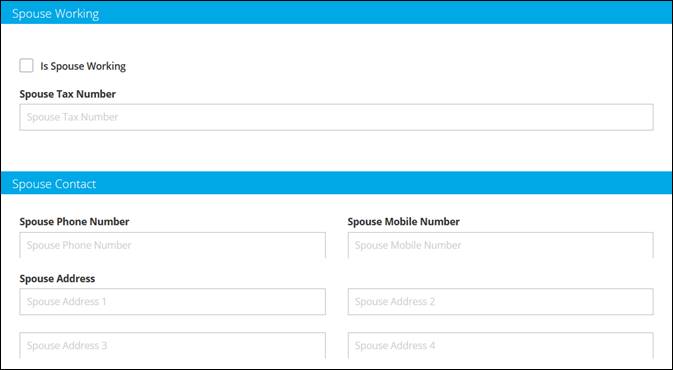

Here you may maintain spouse working information and contact number.

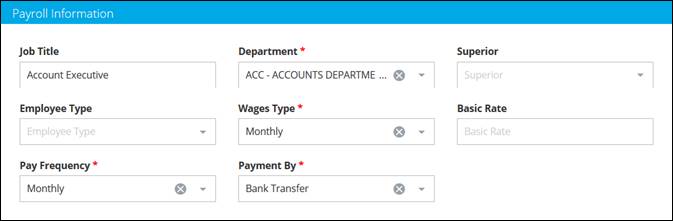

ii) Employment Detail

Go to Employment Detail tab to maintain the employee’s employment details (i.e. Job Title, Wages Amount, Join & Confirm Date).

Wages Type: Monthly – Wages is calculated by monthly

Daily – Wages is calculated by daily

Hourly – Wages is calculated by hourly

Piece Rate – Wages is calculated by piece (i.e quantity of item)

Wages Amount: Insert employee’s Basic Rate amount. This amount will capture in payroll process.

Pay Frequency: Monthly – Salary is paid every month

Fortnightly – Salary is paid twice a month

Payment By: Choose salary payment method (Bank Transfer, Cheque or Cash)

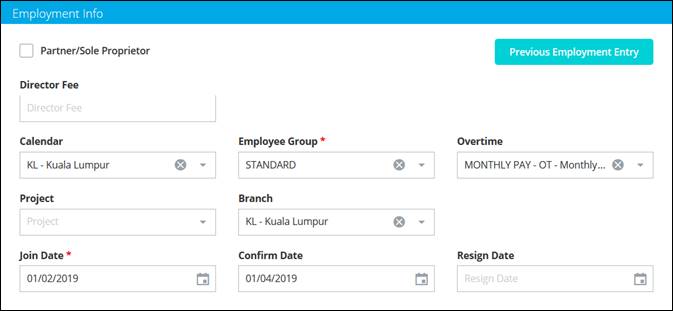

Partner/Sole Proprietor: Tick on this option if the employee is one of the partners of the company or sole-proprietor, then all the tax exemptions will not be applied.

Director Fee: Key in director fee amount. This amount will capture in monthly salary payment

Calendar: Assign calendar for employee. This calendar setting will determine the month working days, working hour, rest days and holiday.

Employee Group: Set employee group. This employee group will determine leave entitlement days and claim limit setting for employee.

Overtime: Set which table will

be used to calculate employee’s overtime.

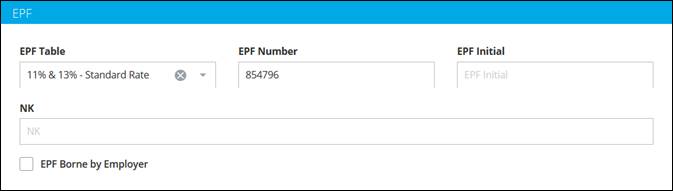

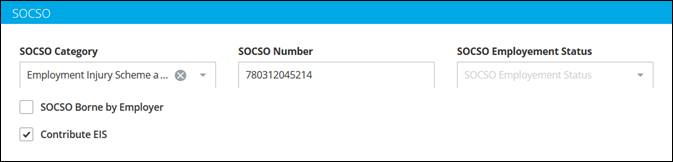

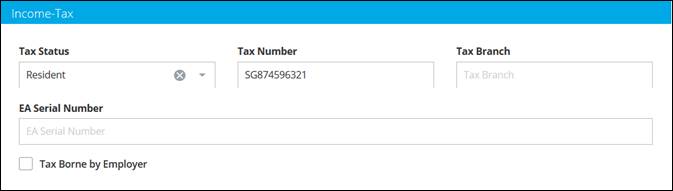

iii) Statutory Requirement

Go to Statutory Requirement tab to maintain the employee’s statutory information (i.e. EPF, SOCSO & Income Tax).

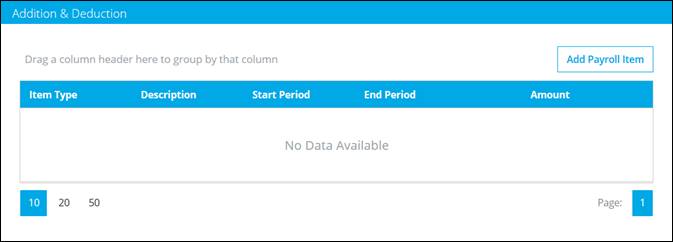

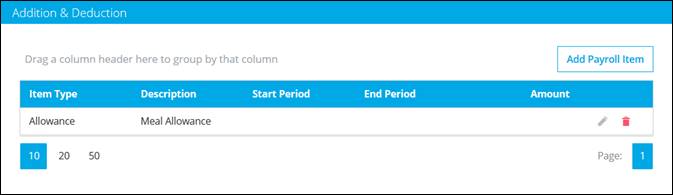

iv) Addition & Deduction

Go to Addition & Deduction tab to maintain recurring setting for Allowance, Deduction, Optional Deduction & BIK for each employee.

Click on Add Payroll Item button to add recurring Allowance, Deduction, Optional Deduction & BIK.

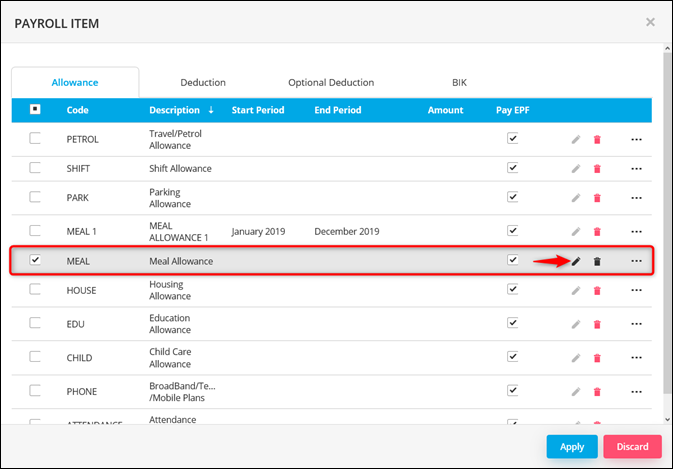

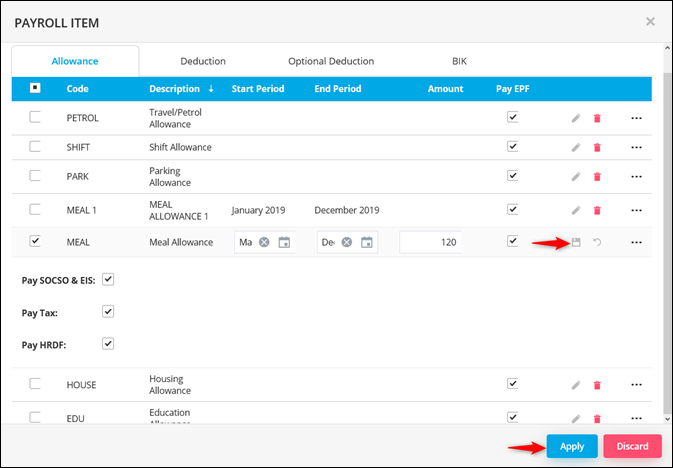

Example: This employee is having fixed Meal Allowance from May 2019 to December 2019.

Check the Allowance checkbox, then click Edit button.

Set the start period from and end period then key in the allowance amount.

You may also set the contribution setting for the allowance.

Click on save icon then Apply button to save the recurring setting.

Saved allowance will appear in the listing.

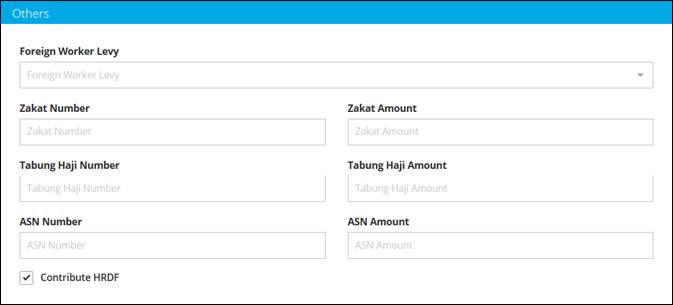

v) Other Information

This is to maintained employee’s other information such as education & working experience.

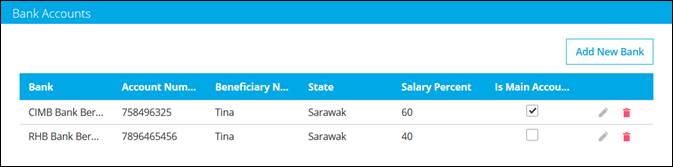

vi) Bank Accounts

This is to maintain employee’s bank account number. User can maintain more than one bank account and determine the salary percentage for each bank.

Click on Add New Bank button. Select bank, maintain bank account number and other information.

Salary Percent: Set the salary percentage for each bank account if you maintain more than one bank account for employee

Is Main Account: All the payroll process payment will be credited to this Main Bank

Account except salary. Salary will base on percentage (if any).