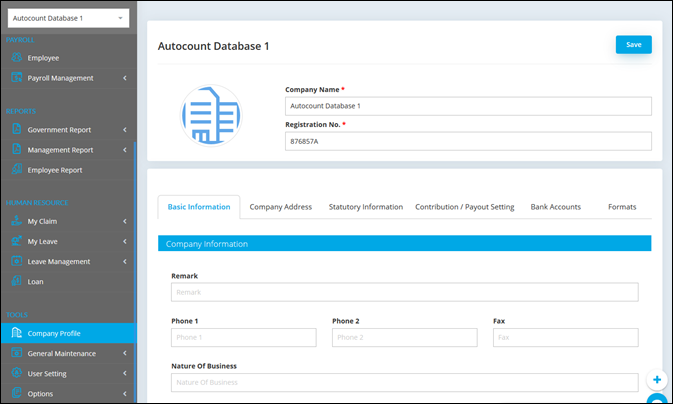

Here you may maintain your company profile information and its related setting (i.e. statutory setting, contribution setting, bank account information and numbering format).

Go to Tools > Company Profile

The following screen will be prompted. There are six sections where you need to fill in.

1. Basic Information

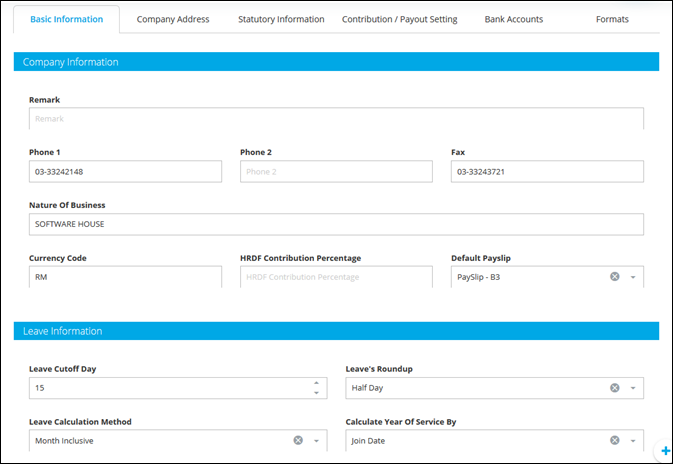

Here you may key in all the company basic information (i.e. phone number, HRDF rate, default payslip and leave information).

HRDF Contribution Percentage: Indicate the HRDF (Human Resource Development Fund) rate if the company is subjected to HRDF.

Default Payslip: Set the company default payslip. This format will be used by employee user to download their payslip from Employee Self Service (ESS) Portal.

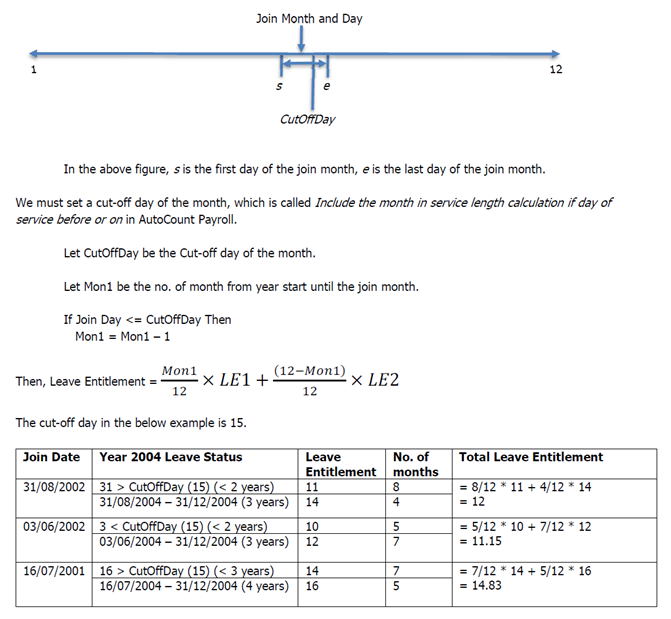

Leave Cutoff Day: Specify the cut off date for system to calculate the leave entitlement. This setting is only applicable if Month Inclusive method is use.

Leave’s Roundup: Set the round up figure for the system to do rounding.

Hourly: System will round up leave entitlement to nearest hour.

Half Day: System will round up leave entitlement to half day.

Full Day: System will round up leave entitlement to full day.

Leave

Calculation Method: Select leave calculation method to calculate leave

entitled days.

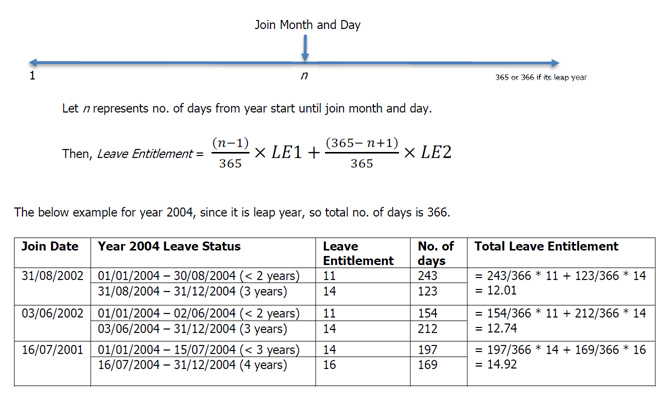

AutoCount Cloud HRMS support 3 types of leave entitlement calculation method, which are Days Method, Month Inclusive and Month Proportion. The following paragraph gives the details of such method.

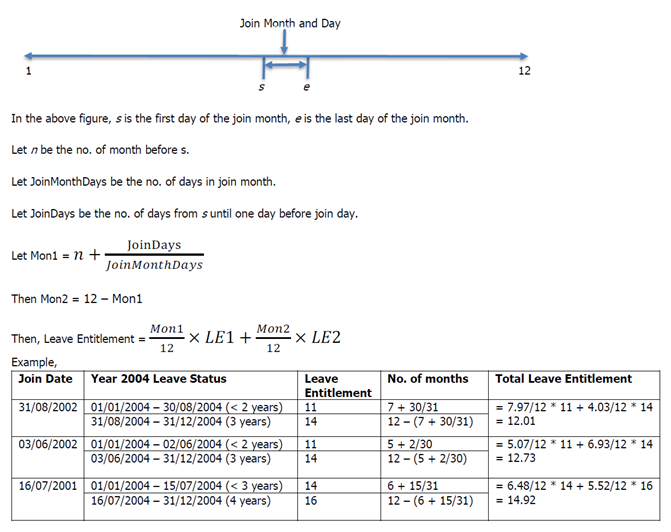

Let LE1 be the leave entitlement before Joint Date.

Let LE2 be the leave entitlement on and after Join Date.

Join Month is the month of the Join Date, while Join Day is the day of the Join Date.

A. Days Method

B. Month Inclusive Method

C. Month Proportion Method

Calculate Year Of Service By: Select which date to calculate year of service between join date or confirm date.

If user select Join Date, the system will calculate the leave entitlement starting from the date the employee joined the company.

If user select Confirm Date, the system will calculate the leave entitlement starting from the date the employee is confirm as permanent staff in the company.

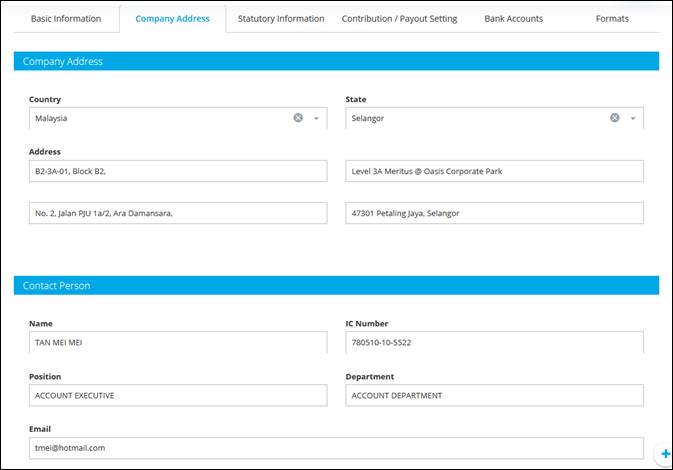

2. Company Address

Click on Company Address tab to enter company address and contact person information.

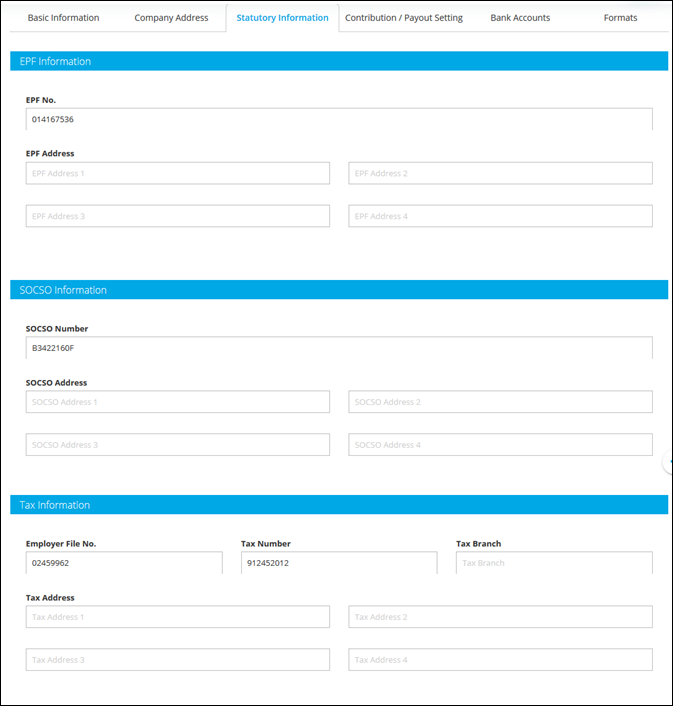

3. Statutory Information

Click on Statutory Information tab to maintain company’s Tax, SOCSO and EPF information (number and address).

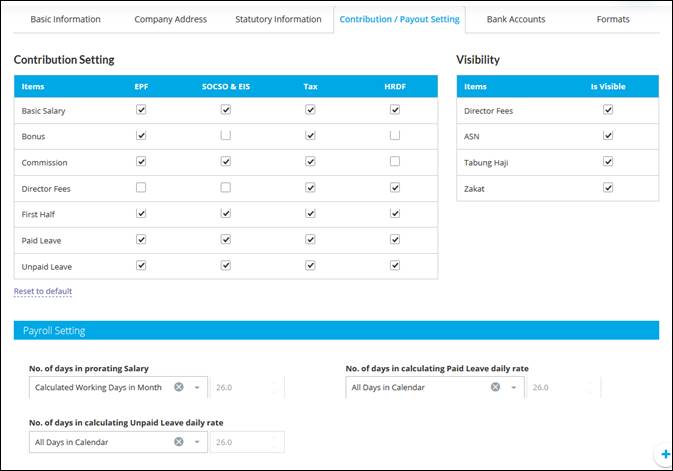

4. Contribution/Payroll Setting

Go to Contribution/Payroll Setting tab to indicate a default contribution setting for the particular item. For example, to pay EPF and tax for Bonus, tick on EPF and Tax.

Visibility: If this

setting is check, items will visible in Payroll Processor as well as in

Employee Maintenance > Statutory Requirement.

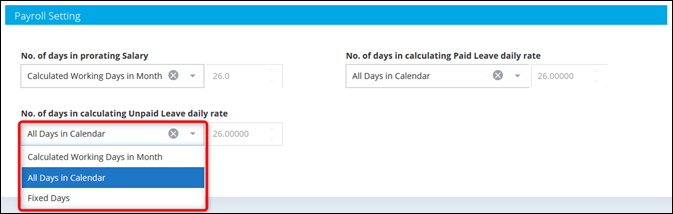

Payroll Setting is to determine how system will calculate the daily rate for prorating salary, paid leave and unpaid leave.

No. of days in prorating Salary: Set the number of days to calculate daily rate for employee salary.

No. of days in calculation Paid Leave daily rate: Set the number of days to calculate daily rate for Paid Leave.

No. of days in calculation Unpaid Leave daily rate: Set the number of days to calculate daily rate for Unpaid Leave.

Calculated Working Days in Month: Number of working days set in Calendar Maintenance. Calendar maintenance is maintained at General Maintenance > Calendar

All Days in Calendar: All days in month (i.e. 31 days for January, 28 days in February & 31 days in March).

Fixed Days: Select fixed days and set number of days calculated.

Example: No of days in calculating Unpaid Leave daily rate is All Days in Calendar

|

Unpaid Leave daily rate for January = |

Basic Salary |

|

|

31 days |

|

Unpaid Leave daily rate for February = |

Basic Salary |

|

|

28 days |

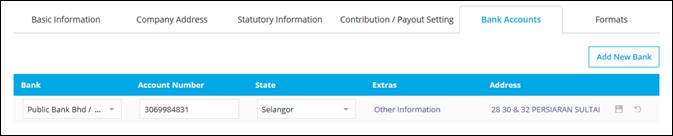

5. Bank Accounts

Go to Bank Accounts tab to maintain company’s bank account information. You may maintain multiple bank accounts for company.

Click Add New Bank to add a new company bank account

Select bank, key in bank account number and select bank state. You may click Other Information and Address button to key in extra information and the bank address.

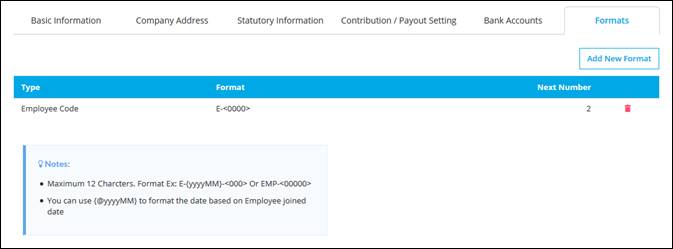

6. Format

Go to Format tab to maintain employee code numbering format. This format will be used in Employee Maintenance - Employee Code field.

Example:

|

Employee |

Employee Code |

Note |

|

Office & Management |

O-02-028 |

O to symbolize Office 02 – created month (February) 028 – running number |

|

Technician |

T-01-064 |

T to symbolize Technician 01 – created month (January) 064 – running number |

|

Factory Worker |

F-06-087 |

F to symbolize Factory 06 – created month (June) 087 – running number |

Click Add New Format button to add a new format. You may refer to the notes given.

Format: Key in the numbering format. Maximum length is 12 Characters.

Example: E-{yyyyMM}-<000> Or EMP-<00000>

'E' is the prefix, the small letter 'yyyy' means the current

year, 'MM' means current month, '-' is a fixed character, and '<000>' is

the running number.