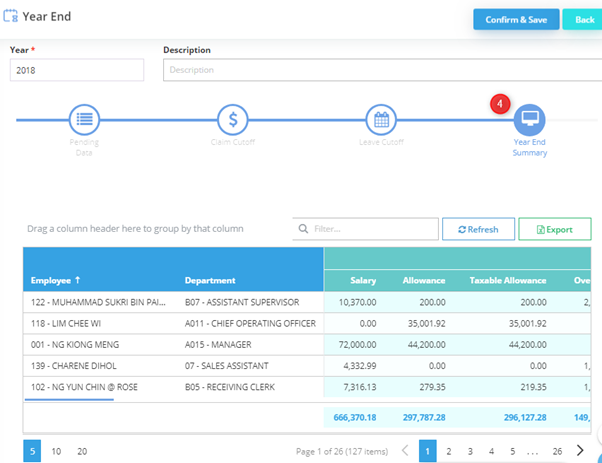

Here you may view and check you Yearly Payroll Summary as these details later will be updated to the EA form figures.

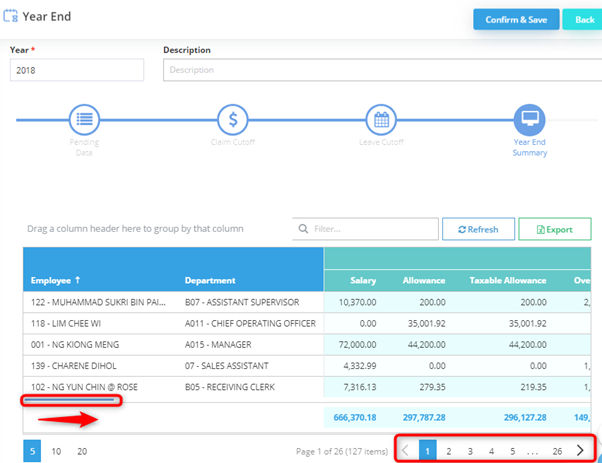

You may scroll to the right to see another payroll detail and click on next page to see another employee pay summary.

*Additional Information: If you use Tax Borne By Employer setting, the total amount for tax paid by employer in the current payroll year will be considered as the following year income. The amount will be added up in January Payroll as an additional remuneration.

E.g.:

For 2018 payroll year, total tax amount for Mr. Danny is RM400.00 and the tax amount is borne by his employer. The RM400.00 will be treated as 2019 income and will affect January 2019 tax calculation in additional remuneration. The amount (RM400.00) will show in Mr. Danny’s 2019 EA form.

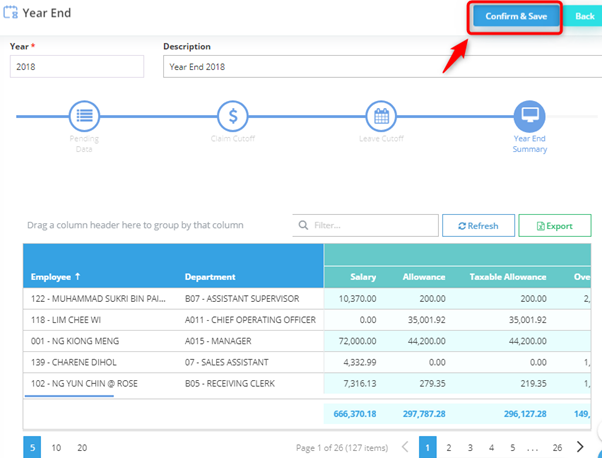

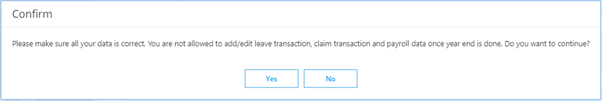

After you confirmed everything in all four sections, you may proceed to process Year End by clicking on Confirm & Save button.

*Note: You need to make sure all your year end summary figure is correct before save as you are no longer able to edit it once it saved.

The following message will be prompted, click on Yes button to continue.

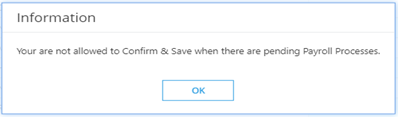

*Additional info: If you have not cleared all Pending Data at the earlier stage, then the following message will be prompted.

Then, you need to clear all pending before can successfully save the year end.

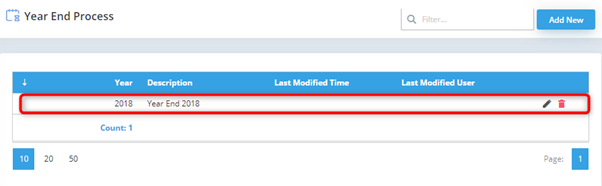

Your year end processor is now created and will be shown at the Year End Process listing screen.